Lauren Has a Gross Pay of 765

Determine laurens net pay if she has the additional items withheld. We provide a range for incomes from zero to 20000 and show you how individual bands and rates apply for each segment of your gross income.

You have a row for pension contributions to input any pension.

. 45 of her gross pay State tax. Lauren has gross pay of 765 and federal tax withholdings of 68. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22 of her federal tax a.

Aniela works at a library and earns 1075h for 30h a week plus 3 vacation pay. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22 of her federal tax a. Medicare tax that is 145 of her gross pay.

Social Security tax that is 62 of her gross pay. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22 of her federal tax. Assuming he makes 9 an hour what is his gross pay.

Who had the higher gross income for the week and by how much. Lauren has gross pay of 765 and federal tax withholdings of 68. Vince earns 1225h as a taxi driver.

Due to rounding for display purposes the values are approximate and not penny accurate. Hannah works at a sporting goods store and earns 1145h for 35h a week. Determine Laurens net pay if she has the additional items withheld-Social Security tax that is 62 of her gross pay-Medicare tax that is 145 of her gross pay-State tax that is 22 of her federal tax a.

Determine Laurens net pay if she has the additional items withheld. State tax that is 22 of her federal tax. Social security tax that is 62 of her gross pay medicare tax that is 145 of her gross pay state tax that is 22 of her federal tax a.

Social Security tax that is 62 of her gross pay. Lauren has gross pay of 765 and federal tax withholdings of 68. Lauren has gross pay of 765 and federal tax withholdings of 68.

Social Security tax that is 6. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22 of her federal tax. Determine laurens net pay if she has the additional items withheld.

Determine laurens net pay if she has the additional items withheld. What was his gross income for the month. Federal withholding tax 68.

Lauren has gross pay of 765 and federal tax withholdings of 68. Lauren has gross pay of 765 and federal tax withholdings of 68. Lauren has gross pay of 765 and federal tax withholdings of 68.

State tax that is. 62352 select the best answer from the. Determine laurens net pay if she has the additional items withheld.

Social security tax that is 62 of her gross pay medicare tax that is 145 of her gross pay state tax that is 22 of her federal tax a. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22. Determine Laurens net pay if she has the additional items withheld.

Gross pay 765. Social Security tax that is 6. Social security tax that is 62 of her gross pay medicare tax that is 145 of her gross pay state tax that is 22 of her federal tax a.

Lauren has gross pay of 765 and federal tax withholdings of 68. Answered expert verified. Social Security tax that is 62 of her gross pay Medicare tax that is 145 of her gross pay State tax that is 22 of her federal tax a.

Determine Laurens net pay if she has the additional items withheld. Determine Laurens net pay if she has the additional items withheld. 62352 please select the best answer from the choices.

Lauren has gross pay of 765 and federal tax withholdings of 68. Determine Laurens net pay if she has the additional items withheld. Correct answer to the question Lauren has gross pay of 765 and federal tax withholdings of 68.

Determine laurens net pay if she has the additional items withheld. Monthly calculations are made on a Month One basis. Determine Laurens net pay if she has the additional items withheld.

Social security tax that is 62 of her gross pay medicare tax that is 145 of her gross pay state tax that is 22 of her federal tax a. Medicare tax that is 145 of her gross pay. Determine Laurens net pay if she has the additional items withheld.

Determine Laurens net pay if she has the additional items withheld. Determine Laurens net pay if she has the additional items withheld. Lauren has gross pay of 765 and federal tax withholdings of 68.

Lauren has gross pay of 765 and federal tax withholdings of 68. Laurens net pay is 62352. Terms in this set 13 Lauren has gross pay of 765 and federal tax withholdings of 68.

Laurens net pay is 62352. 2 of her gross pay Medicare tax that is 1. Determine Laurens net pay if she has the additional items withheld.

Up to 24 cash back and 40 h on nights. Lauren has gross pay of 765 and federal tax withholdings of 68. Lauren has gross pay of 765 and federal tax withholdings of 68.

2 of her gross pay Medicare tax that is 1. 45 of her gross pay State tax that is 22 of her federal tax a. Determine laurens net pay if she has the.

Lauren has gross pay of 765 and federal tax withholdings of 68. Lauren has gross pay of 765 and federal tax withholdings of 68.

Net Pay Vs Gross Pay Flashcards Quizlet

Solved Mary Ehrat An Employee Of Sheffield Company Has Chegg Com

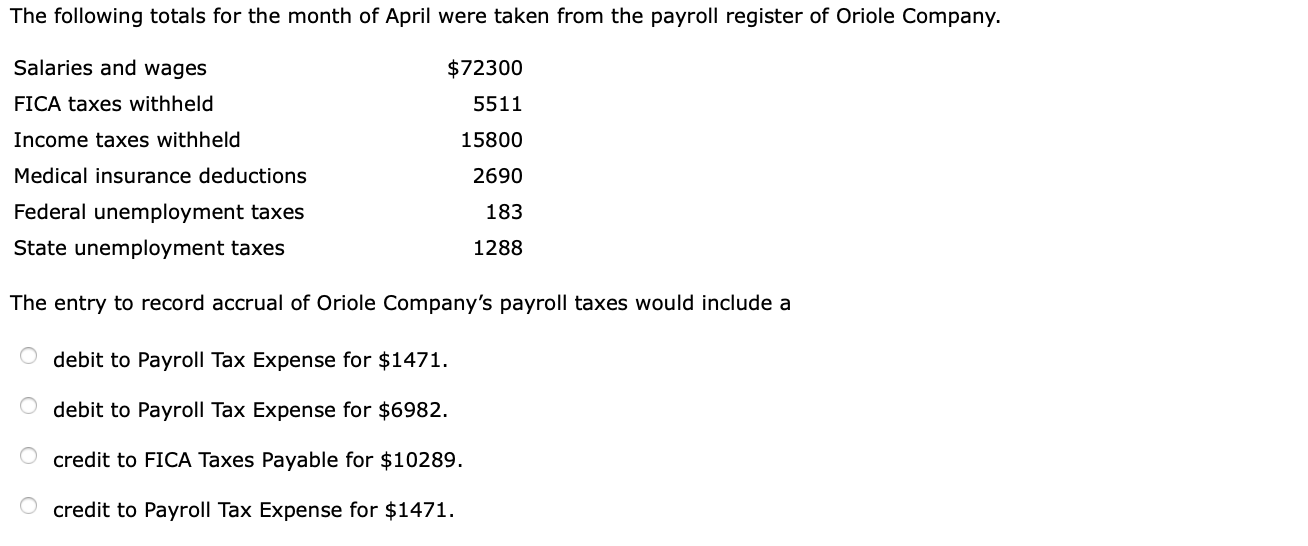

Cancers Free Full Text Predicting Peritoneal Dissemination Of Gastric Cancer In The Era Of Precision Medicine Molecular Characterization And Biomarkers Html

No comments for "Lauren Has a Gross Pay of 765"

Post a Comment